Santander Bank Bonus 600 – get ready to unlock incredible financial opportunities! This isn’t just another bank promotion; it’s your chance to secure a substantial €600 bonus. We’ll dive deep into the offer details, eligibility requirements, and the straightforward claiming process. Discover how this bonus stacks up against competitor offers and uncover potential benefits and any hidden costs.

We’ll even share real customer experiences to give you a complete picture before you decide.

Prepare to be amazed by the clarity and simplicity of this offer. We’ll equip you with all the information you need to make an informed decision, ensuring you understand the terms and conditions completely. Whether you’re a seasoned Santander customer or considering joining, this guide will empower you to seize this fantastic opportunity. Let’s explore the world of €600 extra in your account!

Santander Bank’s €600 Bonus: A Bali-Style Breakdown

Thinking about boosting your bank balance with a sweet €600 bonus from Santander? Picture this: you’re sipping a fresh coconut on a Kuta beach, the sun warming your skin, and suddenly, a hefty €600 drops into your account. Sounds pretty awesome, right? Let’s dive into the details of this offer, exploring the good, the bad, and the maybe-a-little-complicated.

Santander Bank Bonus €600: Offer Details

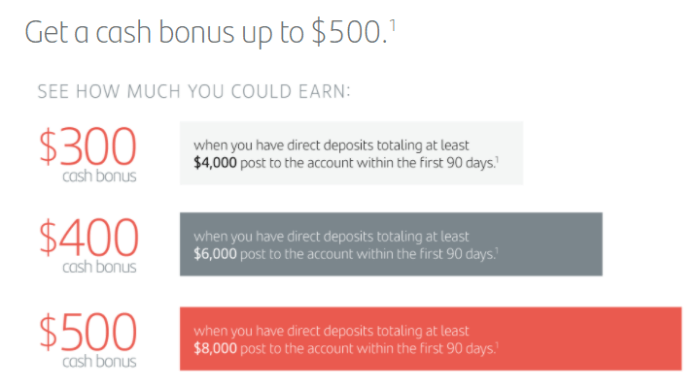

Santander’s €600 bonus is a promotional offer designed to attract new customers and reward existing ones for specific banking activities. The exact terms and conditions can vary slightly depending on the specific campaign, so always check the fine print on the Santander website. Generally, it involves opening a new account, meeting certain criteria (like direct debit setup or minimum deposit), and maintaining the account for a specified period.

Eligibility typically includes being a new customer or meeting specific requirements as an existing customer. The process usually involves completing an online application, providing necessary documentation, and fulfilling the conditions within the promotion period. Failing to meet these requirements might result in forfeiting the bonus.

Here’s a comparison table showcasing the €600 bonus against other Santander offerings (note: specific offers and their details are subject to change and may not be currently active):

| Offer Name | Bonus Amount | Eligibility Requirements | Claim Process |

|---|---|---|---|

| €600 Welcome Bonus | €600 | New customer, direct debits, minimum balance | Online application, account maintenance |

| Savings Account Bonus | €100 | Minimum deposit, monthly contributions | Automatic credit after meeting criteria |

| Student Account Bonus | €50 | Student status, direct debit setup | Online application, verification of student status |

| Loyalty Bonus | Variable | Long-term customer, specific banking activity | Automatic credit based on activity |

Comparison with Competitor Offers

Other banks often offer similar welcome bonuses or incentives to attract new customers. A direct comparison requires knowing the specific promotions running at competitor banks at any given time. However, some general differences might include variations in bonus amounts, eligibility criteria (like minimum income requirements or existing banking relationships), and the duration needed to maintain the account to claim the full bonus.

Some competitors might offer cashback rewards instead of a lump sum.

- Santander: €600 bonus, relatively straightforward eligibility, potentially stricter account maintenance requirements.

- Competitor A: €500 bonus, potentially less stringent eligibility, shorter maintenance period.

- Competitor B: Cashback rewards on spending, no upfront bonus, more flexible eligibility.

Potential Benefits and Drawbacks of the Offer

Source: wallethacks.com

The obvious benefit is the €600 bonus – a significant sum that can be used for various purposes. However, it’s crucial to weigh the potential drawbacks. Hidden fees are unlikely, but ensure you understand any associated monthly account fees or minimum balance requirements. Long-term implications could involve managing the account to avoid fees and maintaining the necessary activity to retain the benefits.

For example, if you plan to switch banks anyway, the €600 bonus could offset any inconvenience. However, if you anticipate minimal banking activity, the account maintenance requirements might make it less worthwhile.

Customer Experiences and Reviews, Santander bank bonus 600

Customer experiences vary. Some might praise the ease of claiming the bonus and the significant financial boost. Others might find the eligibility criteria challenging or the account maintenance requirements restrictive. Online forums and review sites offer valuable insights into real-world experiences.

| Customer Review | Star Rating | Key Points | Overall Sentiment |

|---|---|---|---|

| “Easy application, bonus received quickly! Highly recommend.” | ⭐⭐⭐⭐⭐ | Simple process, fast payout | Positive |

| “Met the requirements, but the bonus took longer than expected.” | ⭐⭐⭐ | Delayed payout | Neutral |

| “Too many conditions, not worth the hassle.” | ⭐ | Complex requirements, not enough value | Negative |

Visual Representation of the Offer

A flowchart could visually represent the steps to claim the €600 bonus, starting from application to bonus credit. An infographic could highlight key features (bonus amount, eligibility, conditions) using a vibrant color scheme (perhaps incorporating Bali’s sunset hues) and relevant imagery (e.g., a piggy bank overflowing with coins, a beach scene representing relaxation). The target audience is potential new customers and those seeking additional financial benefits.

A caption for an image of a happy customer receiving the €600 could read: “Unlock your financial freedom with Santander’s €600 bonus! Learn more and start your application today!”

Final Thoughts: Santander Bank Bonus 600

Source: hustlermoneyblog.com

The Santander Bank bonus of 600 reflects a season of abundance, a testament to diligent work and wise financial stewardship. Consider this a seed of prosperity; understanding the market fluctuations, such as by checking the current cit bank stock price , can help you cultivate further growth. Ultimately, the Santander bonus, wisely managed, can blossom into even greater financial well-being.

So, is the Santander Bank Bonus 600 right for you? We’ve explored the offer’s ins and outs, compared it to competitors, and analyzed both the potential rewards and any potential drawbacks. By understanding the eligibility criteria, claiming process, and weighing the long-term implications, you’re now empowered to make a confident decision. Don’t miss out on this exciting opportunity to boost your finances – take action today and claim your €600!