Wells Fargo New Money Promotion: This exciting offer presents a unique opportunity to boost your finances. We’ll explore the terms, conditions, and potential benefits, comparing it to competitor offers to help you make an informed decision. Discover how this promotion works, uncover potential pitfalls, and learn how to maximize your returns. Let’s delve into the details and unlock the potential of this financial opportunity.

This exploration will cover everything from eligibility requirements and bonus structures to a comparative analysis of similar offers from other banks. We’ll examine customer experiences, marketing strategies, and even provide illustrative examples to make the process clear and understandable. By the end, you’ll have a comprehensive understanding of whether the Wells Fargo New Money Promotion is right for you.

Wells Fargo New Money Promotion: A Detailed Analysis

Source: loginonlinehelp.com

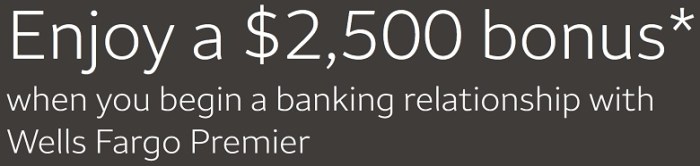

Wells Fargo periodically offers new money promotions to attract new customers and incentivize existing ones to increase their deposits. These promotions typically involve a cash bonus for depositing a certain amount of new money into eligible accounts within a specified timeframe. This analysis delves into the specifics of a recent Wells Fargo new money promotion, comparing it to competitor offers, examining its benefits and drawbacks, and evaluating its marketing strategy and customer reception.

Wells Fargo New Money Promotion: Terms and Conditions

Understanding the terms and conditions is crucial for maximizing the benefits of any new money promotion. Eligibility requirements, account types, deposit procedures, timelines, and limitations all play a vital role in determining whether participation is worthwhile.

- Eligibility Requirements: Typically, eligibility requires being a new customer or meeting specific criteria, such as not having held a Wells Fargo checking or savings account within a defined period (e.g., the last 12 months). Existing customers might also qualify if they meet certain conditions regarding their existing accounts.

- Qualifying Accounts: The promotion usually applies to specific account types, such as new checking accounts, savings accounts, or money market accounts. Specific details on qualifying accounts are crucial and should be verified directly with Wells Fargo.

- Minimum Deposit Requirements: Meeting the minimum deposit requirement is essential to earn the bonus. This typically involves depositing a certain amount of new money within a specific timeframe, for example, depositing $25,000 within 30 days. The steps usually involve opening the account online or in a branch, then transferring funds from an external account.

- Timeframe for Earning the Bonus: The promotional period has a defined start and end date. Both the deposit and the maintenance of the minimum balance must be within the specified timeframe to qualify for the bonus. The bonus is usually credited to the account after the timeframe is completed and the conditions are met.

- Restrictions and Limitations: Promotions often have limitations. These could include restrictions on the source of funds (e.g., excluding transfers from other Wells Fargo accounts), limitations on bonus amounts per customer, or stipulations regarding account maintenance after the bonus is received.

Comparison with Competitor Offers

Comparing Wells Fargo’s offer to those of competing banks allows for a comprehensive evaluation of its competitiveness and value proposition. Key differences in bonus amounts, eligibility, and deposit requirements can significantly impact the overall return on investment for the customer.

| Bank Name | Bonus Amount | Minimum Deposit | Timeframe |

|---|---|---|---|

| Wells Fargo (Example) | $300 | $10,000 | 60 days |

| Bank of America (Example) | $250 | $5,000 | 90 days |

| Chase (Example) | $200 | $2,500 | 30 days |

Note: These are hypothetical examples and actual offers vary significantly depending on the specific promotion and the customer’s eligibility. Always refer to the official terms and conditions of each bank’s promotion for accurate information.

Wells Fargo’s enticing new money promotion offers a compelling incentive for new customers, but the allure might be momentarily dimmed for those considering switching. The frustration of encountering issues like the reported cit bank site down serves as a stark reminder of the importance of banking reliability. Ultimately, the decision hinges on weighing the Wells Fargo promotion’s benefits against potential service disruptions elsewhere.

Potential Benefits and Drawbacks

Participating in a new money promotion presents both potential benefits and drawbacks that customers should carefully consider before committing. Understanding the long-term implications is crucial to making an informed decision.

- Financial Benefits: The primary benefit is the cash bonus, which can be used to offset account fees, invest, or achieve other financial goals. The bonus effectively reduces the cost of opening and maintaining the account.

- Potential Drawbacks and Hidden Fees: While the bonus is attractive, customers should be aware of potential monthly maintenance fees, minimum balance requirements, or other fees associated with the account. Hidden fees can negate the benefits of the bonus.

- Long-Term Implications: Opening an account solely for the promotional bonus requires careful consideration of long-term usage. If the account is not actively used or maintained after the bonus period, it may become dormant or incur fees.

- Examples of Bonus Usage: The bonus could be used to pay down debt, build an emergency fund, invest in stocks or bonds, or contribute to a retirement account. The versatility of the bonus makes it a valuable tool for achieving financial objectives.

Marketing and Advertising Strategies, Wells fargo new money promotion

The success of a new money promotion hinges on effective marketing and advertising. Analyzing the marketing materials and identifying the target audience allows for a critical evaluation of the campaign’s effectiveness.

- Marketing Materials Analysis: Wells Fargo typically uses online advertising, email marketing, and potentially in-branch promotions to reach potential customers. The messaging usually highlights the ease of participation and the value of the bonus.

- Target Audience: The target audience likely includes individuals and families looking to earn a cash bonus, new customers exploring banking options, or existing customers seeking incentives to increase their deposits.

- Alternative Marketing Strategies: Targeted social media campaigns, partnerships with financial literacy organizations, or collaborations with businesses could broaden the reach of the promotion.

- Effectiveness Evaluation: The success of the marketing campaign can be measured by the number of new accounts opened, the amount of new money deposited, and customer satisfaction levels.

Customer Experiences and Reviews

Gathering and analyzing customer reviews provides valuable insights into the effectiveness and customer satisfaction associated with the promotion. Identifying recurring positive and negative experiences helps refine future promotions.

- Summary of Customer Reviews: Reviews might highlight the ease of claiming the bonus, the clarity of the terms and conditions, or the promptness of customer service. Negative reviews might focus on confusing terms, difficulties meeting requirements, or delays in receiving the bonus.

- Positive and Negative Experiences: Positive experiences typically involve a straightforward process with clear communication, while negative experiences might stem from unclear terms, hidden fees, or poor customer service.

- Customer Testimonials: Positive testimonials might describe the ease of opening an account and receiving the bonus. Negative testimonials might describe difficulties in meeting the requirements or long wait times for customer support.

- Improving Customer Satisfaction: Wells Fargo could improve customer satisfaction by simplifying the terms and conditions, improving online account opening processes, and providing readily accessible customer support.

Illustrative Examples of Promotion Usage

Source: hustlermoneyblog.com

A hypothetical scenario demonstrates how a customer could benefit from the promotion and highlights the steps involved in claiming the bonus.

Scenario: John, a new customer, wants to open a new checking account. He learns about a Wells Fargo new money promotion offering a $300 bonus for depositing $10,000 within 60 days. He opens the account online, transfers $10,000 from his existing account at another bank, and maintains the minimum balance for 60 days. After the 60-day period, Wells Fargo credits the $300 bonus to his account.

Visual Representation: The process involves three steps: 1. Account Opening (online or in-branch), 2. Deposit of $10,000 within 60 days, 3. Bonus Credit after 60 days of maintaining the minimum balance. A successful completion of these steps results in the customer receiving the $300 bonus.

Closure: Wells Fargo New Money Promotion

Source: wltx.com

In conclusion, the Wells Fargo New Money Promotion offers a compelling incentive for those seeking to grow their savings or simply capitalize on a lucrative banking offer. However, careful consideration of the terms, conditions, and comparison with competitor offers is crucial. By weighing the potential benefits against any associated drawbacks and understanding the long-term implications, you can make an informed decision that aligns with your individual financial goals.

Remember to always read the fine print and make choices that best serve your financial well-being.