Cit Bank wire transfer fees can seem daunting, a maze of domestic and international charges, sending and receiving bank costs. Understanding these fees is crucial for budgeting and ensuring smooth transactions. This guide unravels the complexities, providing a clear picture of what to expect when sending or receiving money via wire transfer with Cit Bank, empowering you to make informed financial decisions.

We’ll explore the various fees involved, the factors influencing their cost, and practical strategies to minimize expenses. From navigating online and mobile banking platforms to understanding international transfer intricacies, we’ll equip you with the knowledge to handle your wire transfers confidently and efficiently. We’ll also compare Cit Bank’s fees to its competitors, offering a broader perspective on market pricing.

Cit Bank Wire Transfer Fees: A Comprehensive Guide

Source: dnbcgroup.com

Navigating the world of wire transfers can feel like traversing a maze, especially when dealing with varying fees and procedures. This guide provides a clear and concise overview of Cit Bank’s wire transfer fees, empowering you to make informed decisions and optimize your financial transactions. We’ll demystify the process, providing you with the knowledge and strategies to minimize costs and ensure smooth, efficient transfers.

Cit Bank Wire Transfer Fees: Overview

Source: prismic.io

Cit Bank, like other financial institutions, charges fees for wire transfers. These fees vary depending on several key factors, including whether the transfer is domestic or international, the sending and receiving banks involved, and the amount being transferred. Understanding these variables is crucial for budgeting and planning your transactions.

Navigating the intricacies of a Cit Bank wire transfer fee can feel like traversing a labyrinth. Understanding the associated costs is crucial, especially when comparing options. For instance, consider the convenience and potential cost savings offered by alternatives like us bank debit card services , which might offer a different fee structure. Ultimately, a thorough comparison helps determine the most economical method for your specific needs regarding Cit Bank wire transfer fees.

Several factors influence the cost of a wire transfer with Cit Bank. Domestic transfers typically incur lower fees than international transfers due to simpler processing and fewer intermediary banks. The sending and receiving banks may also impose their own fees, adding to the overall cost. The amount transferred might not directly influence the fee, but larger sums could involve additional scrutiny and potentially higher fees in some cases.

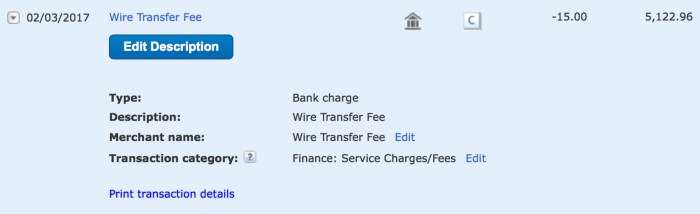

Below is a sample breakdown of typical wire transfer fees for various scenarios. Note that these are examples and actual fees may vary. Always confirm the current fees with Cit Bank directly before initiating a transfer.

| Scenario | Cit Bank Fee (USD) | Sending Bank Fee (USD) | Receiving Bank Fee (USD) |

|---|---|---|---|

| Domestic Transfer (Under $10,000) | $25 | $0 | $0 |

| Domestic Transfer (Over $10,000) | $35 | $0 | $0 |

| International Transfer (USD to EUR) | $45 | $10 | €15 |

| International Transfer (USD to GBP) | $50 | $15 | £10 |

A comparison with major competitors reveals a competitive landscape. While precise fee structures are subject to change, Cit Bank generally aligns with industry standards. It’s always advisable to compare fees directly with other banks before making a decision.

Domestic Wire Transfers with Cit Bank

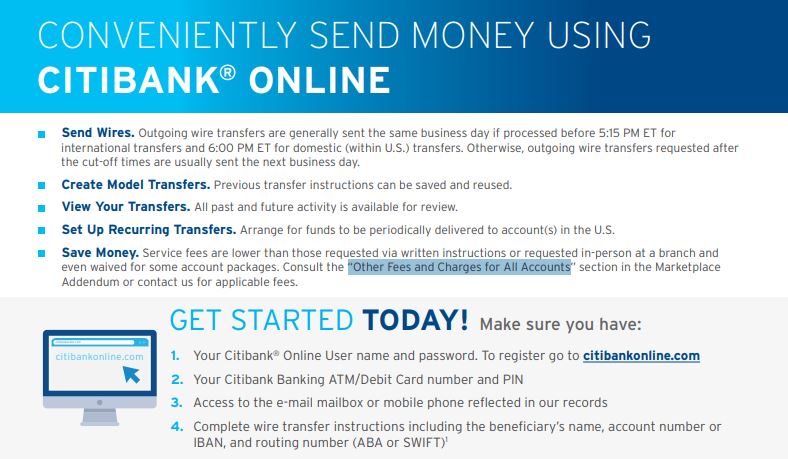

Initiating a domestic wire transfer through Cit Bank’s online banking platform is a straightforward process. You will need the recipient’s account details, including their full name, account number, and the bank’s routing number. The typical processing time for domestic wire transfers is usually one business day, though this can sometimes vary based on bank processing times.

- Log in to your Cit Bank online banking account.

- Navigate to the “Transfers” or “Wire Transfers” section.

- Select “Domestic Wire Transfer.”

- Enter the recipient’s information: full name, account number, and routing number.

- Specify the transfer amount.

- Review and confirm the transfer details.

- Authorize the transfer.

Sending a domestic wire transfer via Cit Bank’s mobile app follows a similar process, with the convenience of accessing your account from anywhere.

International Wire Transfers with Cit Bank

International wire transfers involve a more complex process than domestic transfers, often resulting in higher fees and potential delays. The additional information required includes the recipient’s bank details, including the SWIFT code (BIC code), account number, and full address. Potential delays can arise from currency conversion, intermediary banks, and regulatory compliance checks.

- Issue: Incorrect beneficiary information. Solution: Double-check all details before initiating the transfer.

- Issue: Delays due to intermediary banks. Solution: Choose a bank with a strong international network.

- Issue: Currency conversion issues. Solution: Clarify the exchange rate and fees upfront.

Minimizing Wire Transfer Fees with Cit Bank, Cit bank wire transfer fee

While wire transfers offer speed and security, their fees can be substantial. Several strategies can help minimize these costs. Negotiating lower fees with Cit Bank’s customer service is a possibility, particularly for high-volume transfers. Exploring alternative payment methods, such as ACH transfers or international money transfer services, can sometimes prove more cost-effective.

- Negotiate with Cit Bank’s customer service for large transfers.

- Consider ACH transfers for domestic payments.

- Explore international money transfer services for lower fees (but potentially slower processing).

Cit Bank’s Wire Transfer Policies and Procedures

Cit Bank adheres to specific policies regarding wire transfer limits and restrictions. These are designed to ensure security and compliance. Robust security measures are in place to protect against fraudulent wire transfers, including verification processes and transaction monitoring. In case of errors, Cit Bank Artikels a clear process for disputing or reversing a wire transfer, usually involving providing detailed documentation and contacting customer support.

Accessing and understanding Cit Bank’s official documentation regarding wire transfer fees and procedures is crucial. This information is typically available on their website, in branch locations, or through contacting customer support.

Illustrative Examples of Wire Transfer Scenarios

Let’s illustrate the cost calculation for a domestic wire transfer. Assume a $5,000 transfer with a $25 Cit Bank fee and no additional fees from sending or receiving banks. The total cost would be $5,025. For an international transfer, let’s consider a $10,000 transfer from USD to EUR. Assuming a $45 Cit Bank fee, a $10 sending bank fee, and a €15 receiving bank fee (converted to USD at the current exchange rate), the total cost would be significantly higher, requiring a precise calculation based on the current exchange rate.

A scenario involving a delayed wire transfer might involve incorrect beneficiary information. Resolving this would necessitate contacting Cit Bank’s customer support, providing the correct information, and potentially initiating a reversal or correction of the transfer. A visual representation of the wire transfer process would show the stages: initiation, processing by sending bank, intermediary bank processing (if applicable), processing by receiving bank, and finally, credit to the recipient’s account.

Last Point

Source: uscreditcardguide.com

Successfully navigating the world of wire transfers with Cit Bank requires understanding the associated fees and processes. By employing the strategies discussed – from choosing the optimal transfer method to proactively addressing potential issues – you can significantly reduce costs and ensure a smoother, more efficient experience. Remember to always review Cit Bank’s official documentation for the most up-to-date information and policies.

Empowered with knowledge, you can confidently manage your financial transactions.